Financial Times:

Renminbi use surges in home of US dollar

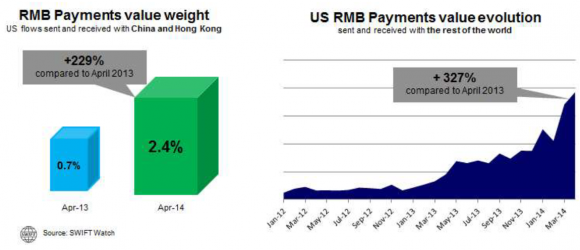

It is the monetary equivalent of what Chairman Mao called “bombarding the headquarters”. China’s renminbi is rapidly displacing the US dollar as a trading currency not only in Asia and Europe but now also in the US home market.The value of renminbi payments between the US and the rest of the world rose by 327 per cent in April this year from the same month a year ago (see chart) as more US corporations switched to using the Chinese currency to pay for imports from China, according to data from SWIFT, the international currency settlement firm.The reasons driving the upsurge are structural and long-term, said Debra Lodge, a managing director at HSBC in New York.First, US importers can slash the cost of imports from China by agreeing to trade in renminbi rather than US dollars, Lodge said. Second, a recent surge in the popularity of a host of renminbi-denominated financial market instruments are making it easier for US corporates both to hedge currency risk and to earn an investment return from the renminbi they hold.Source: SwiftAs the chart above shows, the absolute size of renminbi settlement between the US and China is far less impressive than the growth rate. Just 2.4 per cent of payments between the US and China/Hong Kong were settled in renminbi in April this year, up from 0.7 per cent in April 2013.However, this is set to change in an emphatic way. “By the end of 2015, we think that 30 per cent of (China’s) global trade will be settled in renminbi, up from 13 to 15 per cent now,” said Lodge.Until now, large Chinese companies have been driving much of the switch from the greenback to the redback, but this is changing. “I think over the next two years we are going to see a much greater uptake from small and medium enterprises in China using renminbi (for trade with the US),” Lodge said.This shift, Lodge says, is partly prompted by the recent depreciation of the renminbi, which has lost 3.2 per cent against the US dollar so far this year. Previously, when renminbi appreciation was regarded as a one-way bet, Chinese exporters had a habit of transferring their foreign exchange risk to US importers by insisting on a lower dollar value.Thus if the prevailing official exchange rate was around Rmb6 to the US dollar, US importers would often have to agree to contracts that valued the Chinese currency at Rmb5.8, making Chinese imports more expensive, Lodge said. But after switching to renminbi-denominated trade, US importers no longer have to pay an exchange rate premium to Chinese exporters.

We should be SURE we understand that development of POLITICAL, and MILITARY power, and thus DETERRENCE must be first founded on economic power and NOTHING ELSE COUNTS.

For Chinese exporters, a shift to the renminbi eliminates exchange rate risk and is therefore popular, Lodge said. US importers, meanwhile, can hedge their currency exposure in an increasingly liquid offshore market for renminbi financial instruments.

Such instruments include renminbi forwards, foreign exchange swaps, offshore renminbi options and “dim sum” bonds. The yield on the 10-year Chinese government dim sum bond, for instance, is currently at 4.00 per cent, offering a premium to the equivalent US treasury bond. Meanwhile, a dim sum bond issued by Caterpillar, the US machinery company, is trading at a yield of 2.95 per cent for 2016 maturity.Although the shift from greenback to redback is animated by commercial considerations, it also carries a strategic resonance. China’s promotion of the renminbi internationally was impelled by the frustration Beijing felt in 2008 and 2009 as it watched the value of its vast US treasury holdings plunge along with the dollar’s value.But the ongoing substitution of US dollar export earnings for renminbi earnings is helping to wean Beijing off its reliance on US debt markets. Over time, this is set to free China by degrees from its uncomfortable inclusion in the US dollar zone and boost its financial independence.

2 comments:

I think Obama should sign a treaty that the Russians are allowed to take back Alaska, and the Muslim Brotherhood gets to take all our daughters as booty.

Currencies go up and down every day, every week, every year, to see a true picture you have to look long-term.

40 years ago the Swiss Franc was 25c US, Sterling was $2.80, the South African Rand was $1.50 as was the Rhodesian Dollar.The Pakistani Rupee was 7 to the dollar.

Today the Swiss Franc is $1.25. sterling about $1.70, the Rand is 15c, the Rhodesian dollar is one wheelbarrow load per US (the largest note printed is one trillion i.e.12 zeros) The rupee is about 80 to the dllar.

That is what 40 years of good or bad government will do. The dollar is in the middle of the group right now, I expect it to fall a lot in the next few years

Post a Comment